Take Control — End Your Timeshare Today!

Most Heirs Don't Expect the Timeshare Bill

Avoid leaving your family stuck with fees, fines, and legal headaches.

Your Family Should Inherit Value - Not a Liability

Avoid the surprise timeshare costs that blindside thousands of families each year.

Most people don’t realize it, but timeshares are designed to outlive the original owner.

They get passed down — quietly and automatically — through estate processes, survivorship clauses, or vague contract language.

“I thought I was done with Dad’s estate… then I got hit with a $1,200 maintenance invoice I never agreed to.”

DID YOU KNOW?

Timeshares can legally transfer to family members even if they’re not listed in your will.

Here’s how it happens:

✅ Survivorship Clauses – Many contracts have language that extends ownership to “heirs and assigns”

✅ Estate Liability – Unpaid maintenance fees and assessments may be considered estate debts

✅ Passive Inheritance – Probate courts or HOAs may assign ownership by default if no one objects

✅ Resorts Don't Ask First – They often send bills directly to the next of kin without warning

Even if your children never use it, they may still be on the hook for:

Annual fees

Late penalties

Collection threats

Potential legal action from HOAs or developers

Pro Tip from our Timeshare Heir Rejection Kit

Beware the Hidden Transfer Tactic

Some resorts have been known to use guest check-ins as an opportunity to execute an unintentional transfer of ownership. Here’s how it works:

A family member is invited to use your timeshare for a complimentary stay. Upon arrival, they’re asked to sign “registration paperwork” at the front desk — often presented as routine or required to access the unit.

What they don't realize:

That paperwork may include language that legally assigns them ownership, including all financial obligations tied to the contract — annual fees, special assessments, and potential legal liability.

They think they’re signing in.

They're actually signing up.

What's Inside Our Two Free Guides

You’ll get two critical tools — free, instant download:

The Rejection Kit

For heirs, executors, and family members who don't want the timeshare they're being stuck with.

Sample letters and legal disclaimers

How to block the inheritance in probate

What to do if you've already received a notice

Legacy Exit Guide

For current owners who want to eliminate the problem before it passes down.

Legal ways to exit

How to navigate "forever clauses" and survivorship traps

Insider tips on timing, resale myths, and real solutions

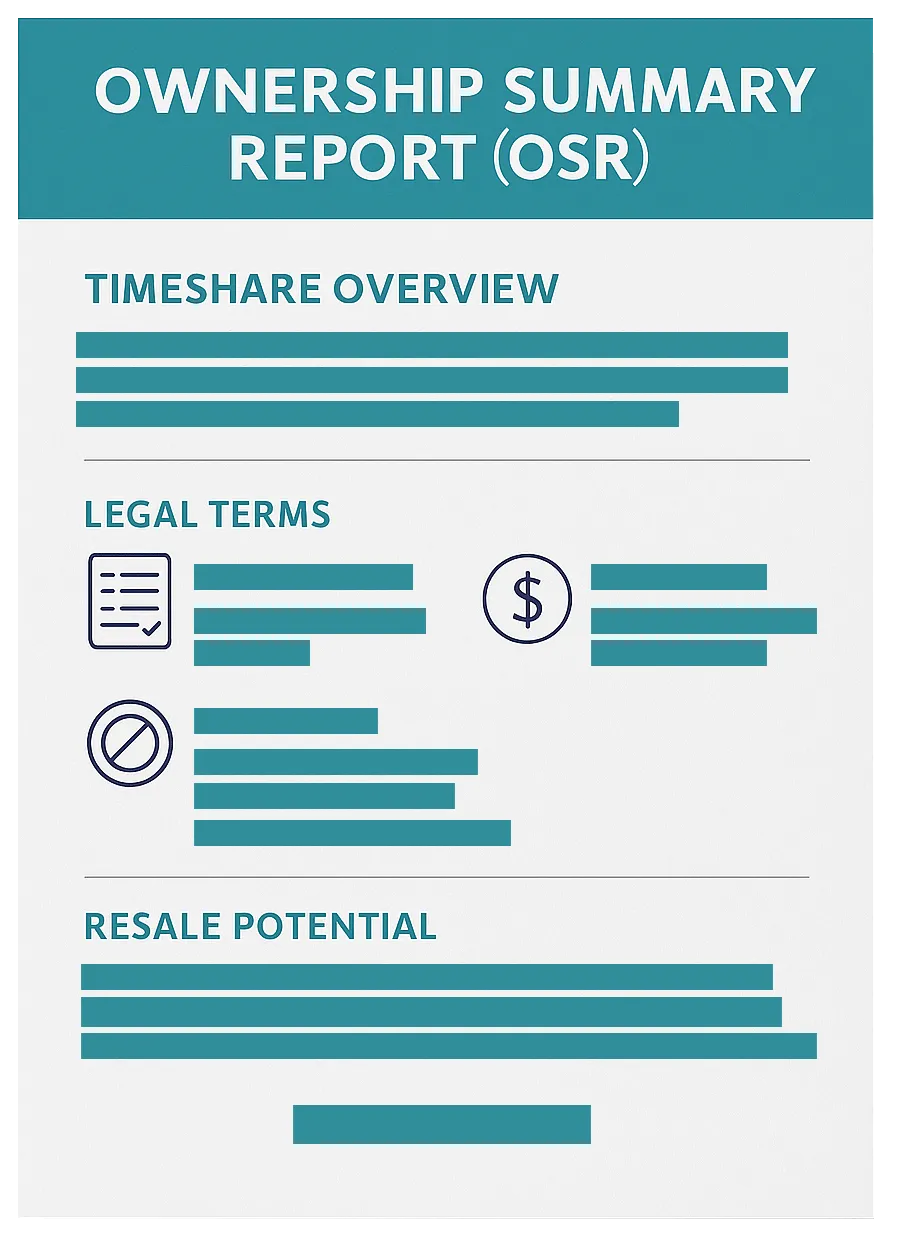

Next Step: Your Ownership Summary Report (OSR)

We can’t give you generic advice — because there’s no such thing as a generic timeshare.

Every OSR we generate is property-specific. It outlines the key legal terms, financial obligations, exit barriers, and even resale potential of your exact contract.

It’s like pulling a credit report — it costs us money to run, and we only do it for serious inquiries.

Why We Need a Quick Call First

Before we can generate your OSR, we need a few details to make sure we pull the correct data from your resort.

We’ve learned that doing this over a brief 10-15 minute call is the fastest, most accurate way to get it right.

Trying to do it with a form alone usually ends up in back-and-forth emails or phone tag — and we’d rather respect your time.

This Is Not a Sales Call

You're not going to be pitched.

You're not going to be pressured.

You're not talking to a “timeshare exit analyst” or salesperson.

You're simply speaking to a trained OSR intake coordinator — someone whose only job is to collect the right information to generate your report and book a follow-up slot if you want to review it later.

That’s it.

We don’t believe in high-pressure tactics — because let’s be honest: that’s probably how you ended up in this situation to begin with.

Real People. Real Relief.

“I had no clue my kids would be on the hook for this. These kits helped me stop the cycle before it was too late.”

– Marilyn S., age 71

“This wasn’t junk mail. It was the truth. Finally.”

_– Allen R., retired Army veteran

Still Unsure? Here's What We Don't Do:

🚫 No spam

🚫 No cold calls

🚫 No sales pressure

What we do offer:

✅ Free education

✅ Free customized contract review (OSR)

✅ Help from former timeshare insiders who’ve seen every dirty trick in the book

🎁 Download Your Free Timeshare Protection Kit

Includes the Rejection Kit, Legacy Exit Guide, and clear next steps to protect your family.

Copyright © 2025 TKO Timeshares, LLC and Timeshareheir.com | All Rights Reserved.